Small Business Loans: What Your Practice Needs to Know for the COVID-19 Crisis

If your practice is facing financial challenges due to the restrictions caused by COVID-19 there is good news. The small business loans offered in the following new relief packages will make a big difference to practices.

- The Families First Coronavirus Response Act (FFCRA Act) passed on March 18 includes extended leave and expands the Small Business Administration (SBA) Disaster Loan program.

- The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) passed on March 27 adds a new loan that has a forgiveness component, tax rebates to individual taxpayers, and other tax provisions.

Many other provisions are outlined in these laws, so take the time to read all of them. This article will outline the details for the two small business loans your practice might want to take advantage of.

How to Choose Veterinary Practice Loans

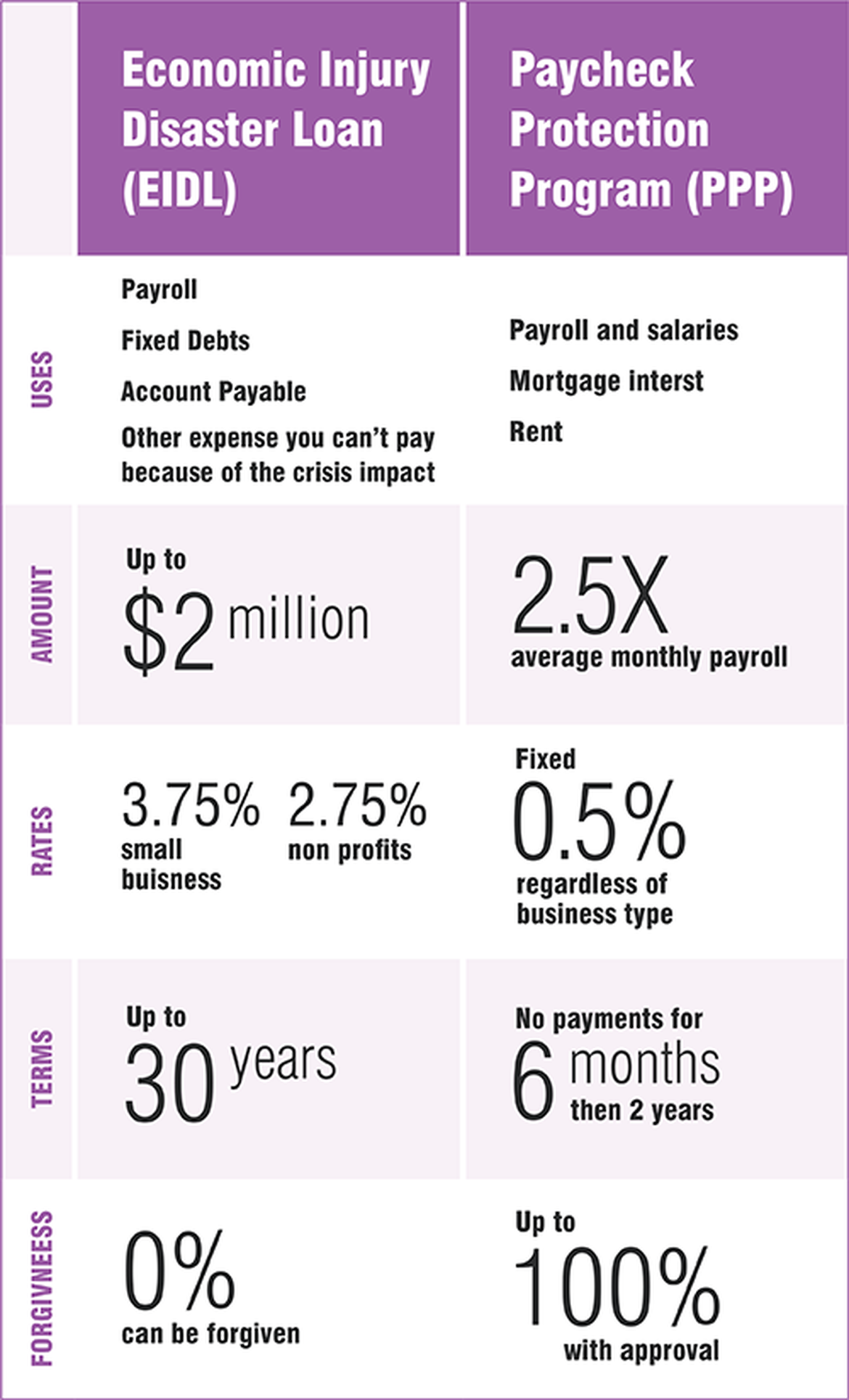

Two types of loans are specifically targeted at the financial challenges practices are facing because of COVID-19. The first is the Economic Injury Disaster Loan (EIDL), an expansion of existing disaster loan provisions offered by the SBA. The second is the Paycheck Protection Program (PPP), a new type of loan offered through existing partner banks. The differences between the programs are outlined in the graphic below. Keep in mind that you cannot use both loans to address the same expenses.

Consider these questions to help choose which loan is best for your practice:

- Do I need funds immediately? The EIDL offers up to $10,000 within three days. This loan is forgivable, even if you don't qualify for or accept the full loan.

- Are the funds for short-term cash flow issues? PPP loans are best for covering operating expenses.

- Are you looking for working capital? Use of PPP funds is more restricted even after the eight-week forgiveness window.

- How much do you need? For most practices, the PPP cap of 2.5 times the monthly payroll is smaller than the EIDL's cap of $2 million.

The PPP includes a 100% loan forgiveness component if you spend the loan on qualifying expenses and follow the other loan rules. The forgiven loan is not taxable, making it a huge benefit. The basics of its rules are:

- The proceeds must be used for payroll costs, rent, mortgage or other debt interest, and utilities.

- A minimum of 75% of the forgiven amount must be used for payroll costs.

- The amount of forgiveness is reduced if you reduce the number of employees, their salaries, or both.

- The amount of forgiveness is reduced by any EIDL advance that is forgiven.

- You can't claim for payments under the new sick leave or Family and Medical Leave Act rules already refunded through payroll tax rebates.

- Taking a PPP loan impacts access to certain other tax deferral programs.

- You must agree not to take any other PPP loan until 2021.

To ensure you qualify for the maximum amount of loan forgiveness, you should carefully consider if you can meet the requirements for fund use. If you are currently closed or operating with a reduced team, you may want to wait so you can meet the required payroll percentage. Work with your PPP lender to ensure funds are used appropriately and don't conflict with other programs.

How to Apply for a Small Business Loan

The application process for each loan is different, although you may need similar information for each. Here's the information you'll need to collect:

- Employer identification number.

- Recent profit and loss statements.

- Bank details.

- Business owners' Social Security numbers.

- Business owners' personal financial data.

How to Apply for the EIDL

Apply for the EIDL directly though the SBA. The process has been simplified since the passage of the CARES Act. The website guides you through the process. The SBA estimates it should take around two hours.

How to Apply for the PPP

The process for applying for the PPP is still being finalized but will be easiest if you work with an existing lender. They should already have many of the details that you'll need to apply. If you need to build a new relationship, start with your current banking provider — most major lenders now have SBA programs or can recommend a partner who can provide these loans. A complete list of the 1,800 participating lenders and other important information can be found at sba.gov.

In addition to the information required for the EIDL, PPP loans require that you provide information on payroll costs, so either four quarters of IRS Form 944 or your year-end Form 941. You will also need to provide details on staff that make over $100,000 a year, as this is outside the scope of the program.

Government authorities are recommending that interested small businesses act quickly as there is currently a cap of $350 billion allocated to the program.

Support for Your Existing Loans

In addition to the new loan options, the acts contain a large benefit for practices with existing small business loans. The SBA is going to pay those loans for six months, on both the principal and interest. This is in addition to any deferral that your lender can offer you. The SBA expects to have it in place this month, so contact your loan provider to make sure they're included in the program and have stopped any automatic drafts. As this program runs consecutively with any deferral, you may be able to take a break of nine or more months from loan payments by staying in regular contact with your lenders.

The Time to Act Is Now

The current environment is extremely stressful for clients, owners, and team members. So, no matter how much you hate paperwork, you should consider taking advantage of these programs. The SBA and lenders have a vested interest in keeping as many practices afloat as possible and reducing the economic impact on small businesses even after the immediate crisis passes. For the sake of yourself and your teams, take the time to create some financial stability, so you can get back to focusing on your patients, your clinic, and most importantly, your health.

The government's guidance around these programs may have changed since publication. Find the latest on these small business loans at the SBA's coronavirus response page.

This article is not an endorsement of any loan or program, and the information provided is not meant to replace the advice of a financial advisor.